Online Experience For Cheque Users

08 Nov 2020 - karit

So some of the major banks in Aotearoa have said that they will be phasing out cheques at some point in 2021. Some may think this is all well and good as cheques are seeing lower usage, but they often haven’t thought about the massive step backwards in usability which dropping cheques will have. For instance I will have to support people with Macular degeneration through this process.

User Interface

Cheques work well as they have a simple UI which works well with a magnifying glass. The web site doesn’t have this level of usability nor do screens work particularly well when viewed with magnifying glass.

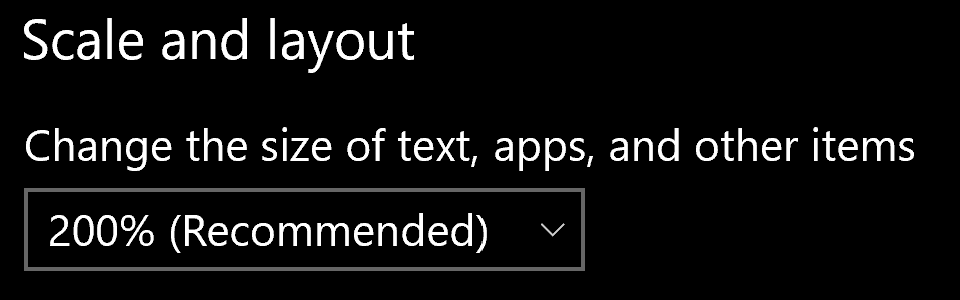

One example, the person already has a 42” screen (well TV, as gave better size for dollar) on their computer. The display scaling is turned up to 200%:

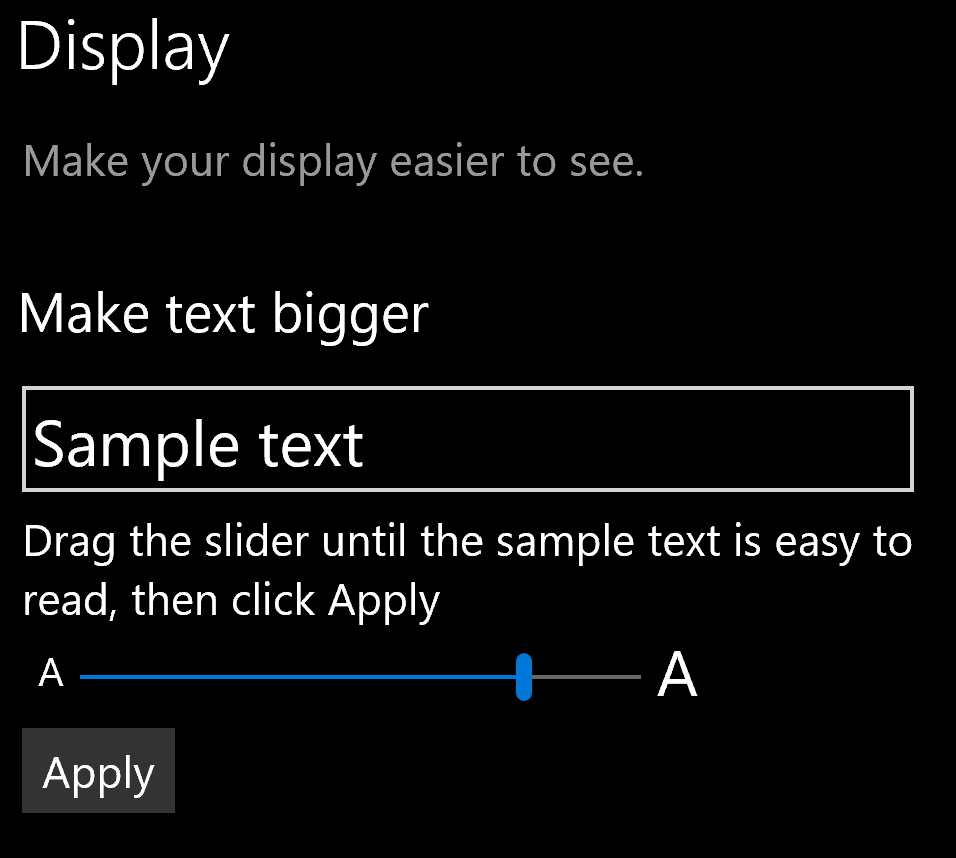

The Windows 10 Font Size is also font size set fairly large:

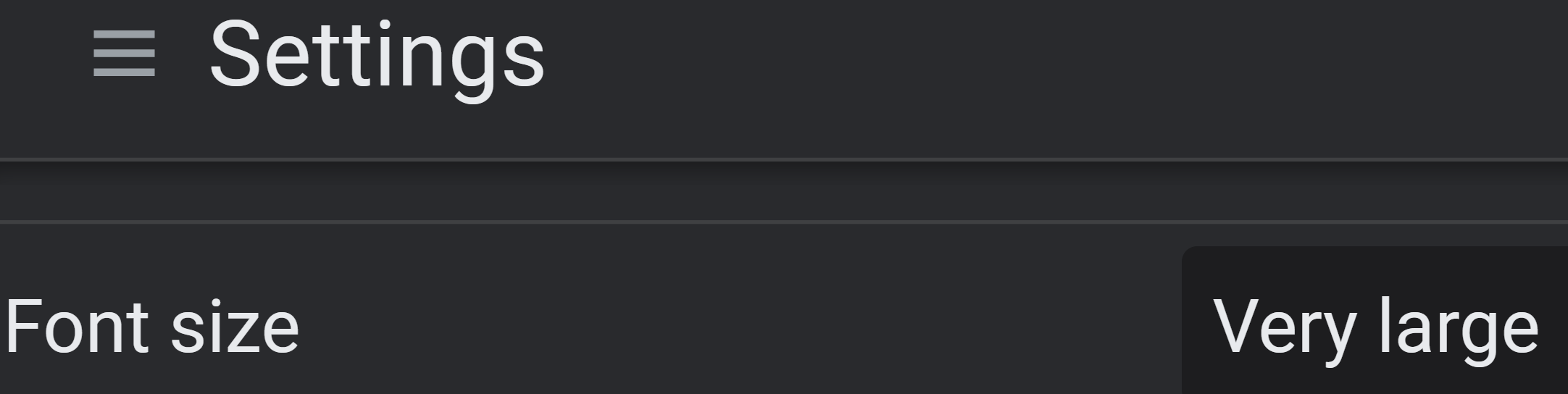

Chrome also has some setting which we have changed as well to make things as large and easy to see as possible. Switching the Chrome font size set to Very large:

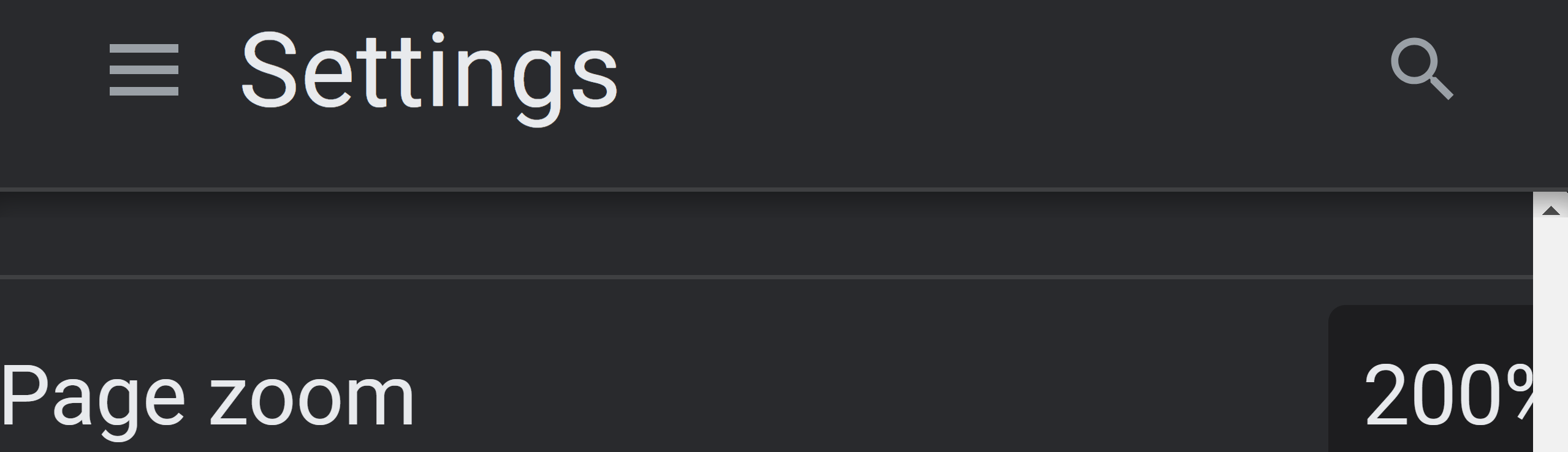

Along the font size being very large the default page zoom is set to 200%:

This results web sites being displayed in such a way they look really broken. The Log On button is hidden behind a different UI element:

![Photo of screen showing the rendering issues of the site] Photo of screen showing the rendering issues of the site](/assets/images/cheque-front-page.jpg)

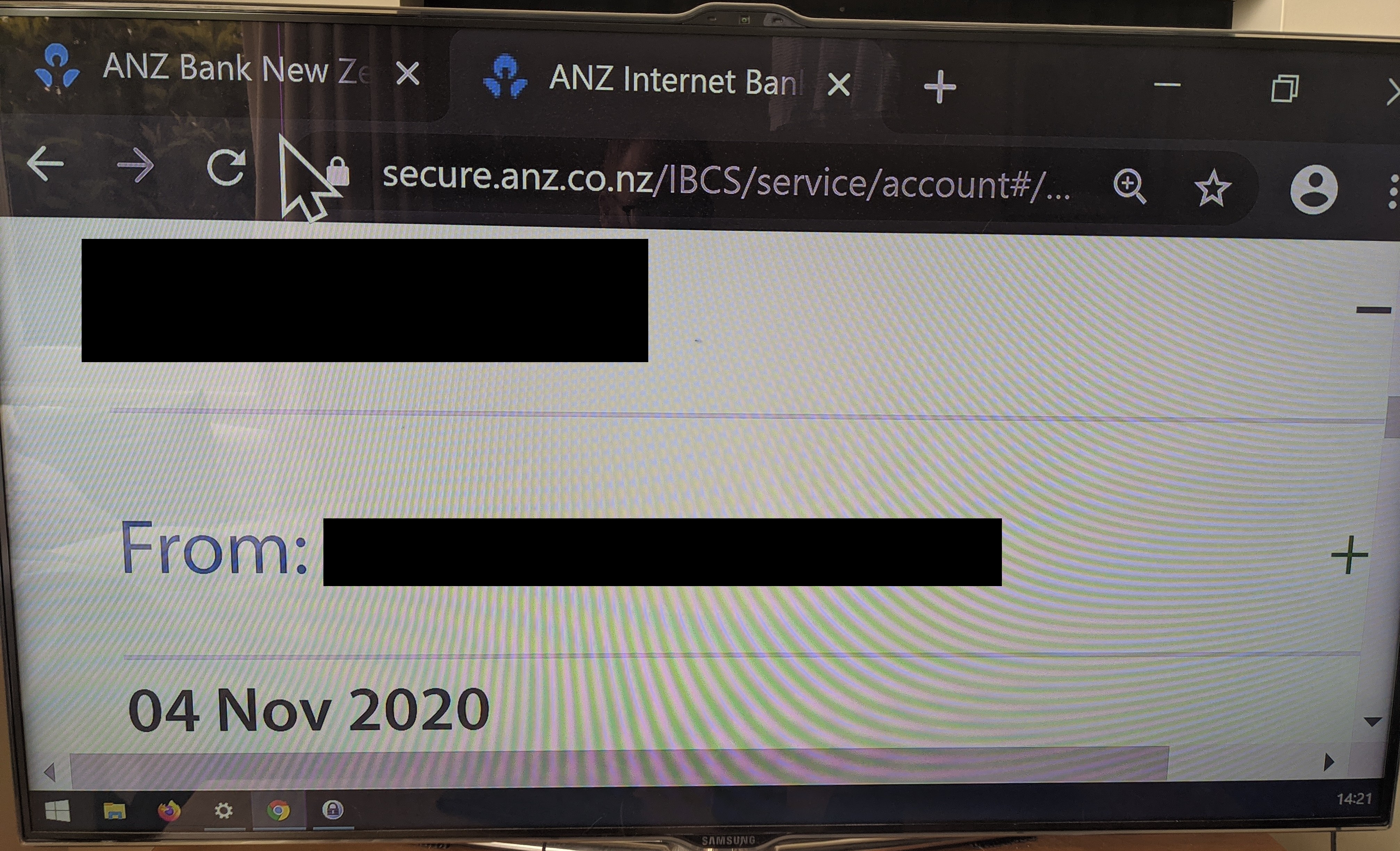

Then when get into the there is horizontal scrolling which makes reading content hard along with content could be missed of the side of the page. You and see the + or - for the amounts, but the amounts are lost off the right hand side of the screen:

Hiding the log on button or requiring horizontal scrolling is making it hard for users to use the system. Go back to a physical cheque, there are no UI elements over lapping with other elements, nor is there a need to horizontal scrolling, when view the cheque using a magnifying glass.

My thinking is that if banks are dropping cheques they should ensure that UI of their web sites has the same ease of use as a cheque. I think running a 42” screen is more that what you can expect a user to do, so the banks need to work on their sites, so they actually work for all of their users, particularly the ones who use cheques but don’t have an online account currently. Please don’t say go to branch, when the banks are closing branches left, right and centre as fast as they can. So more often than not there no is a bank within walking distance (remember not all people drive and public transport in NZ is designed to get people to/from the CBDs at rush hour and not around their local communities).

What needs to be done with the User Interface

Have requirements that the site is usable when the display scaling, increased font size, and page zoom are used. Make sure the teams have access to 42” inch screens with fonts turned up very large, 200% display scaling and 200% page zoom. Have them do their work like that for a couple of days a week to give them a greater appreciation for the range of users who are using their sites. Another one is use the high contrast options, which helps remind people of the important point not to use colours to impart meaning, as it will remove a lot of the colours.

Hopefully we will see some improvements to the UIs of the banking sites before they get rid of cheques.

Other thoughts

This has focused on the visual side of things. There is also the authentication aspects of it all. Will the site support password managers or will it be one of the ones which tries to block pasting of passwords from a password manager.

Will any banks in Aotearoa actually support a easy to use, non phisable, Multi Factor Authentication (MFA) such as U2F or FIDO2? These tokens and touch finger print sensors are really simple to use, just need to touch them. No need to:

- read codes of a phone.

- try to remember where the battle ship card was left.

- type in the 12th, 63rd and 81st character of a 100 character long “security question”, after having to count along the security question to figure out which character to type.

Additionally U2F and FIDO2 currently have no known way to phish them, unlike the above, so they will increase the confidence for people that are hesitant to use online banking. (Though do need to remember that need to the ability to allow users to enrol two or more tokens for their accounts, so they can have backup tokens).